How You May Receive Help

Many United Ways across the country offer the Volunteer Income Tax Assistance (VITA) program, a successful, proven strategy that mobilizes and trains volunteers to provide free tax service to working individuals and their families. United Way of Hernando County is proud to support VITA as a FREE tax preparation program for our Hernando County residents.

Save Money & Avoid Hidden Fees!

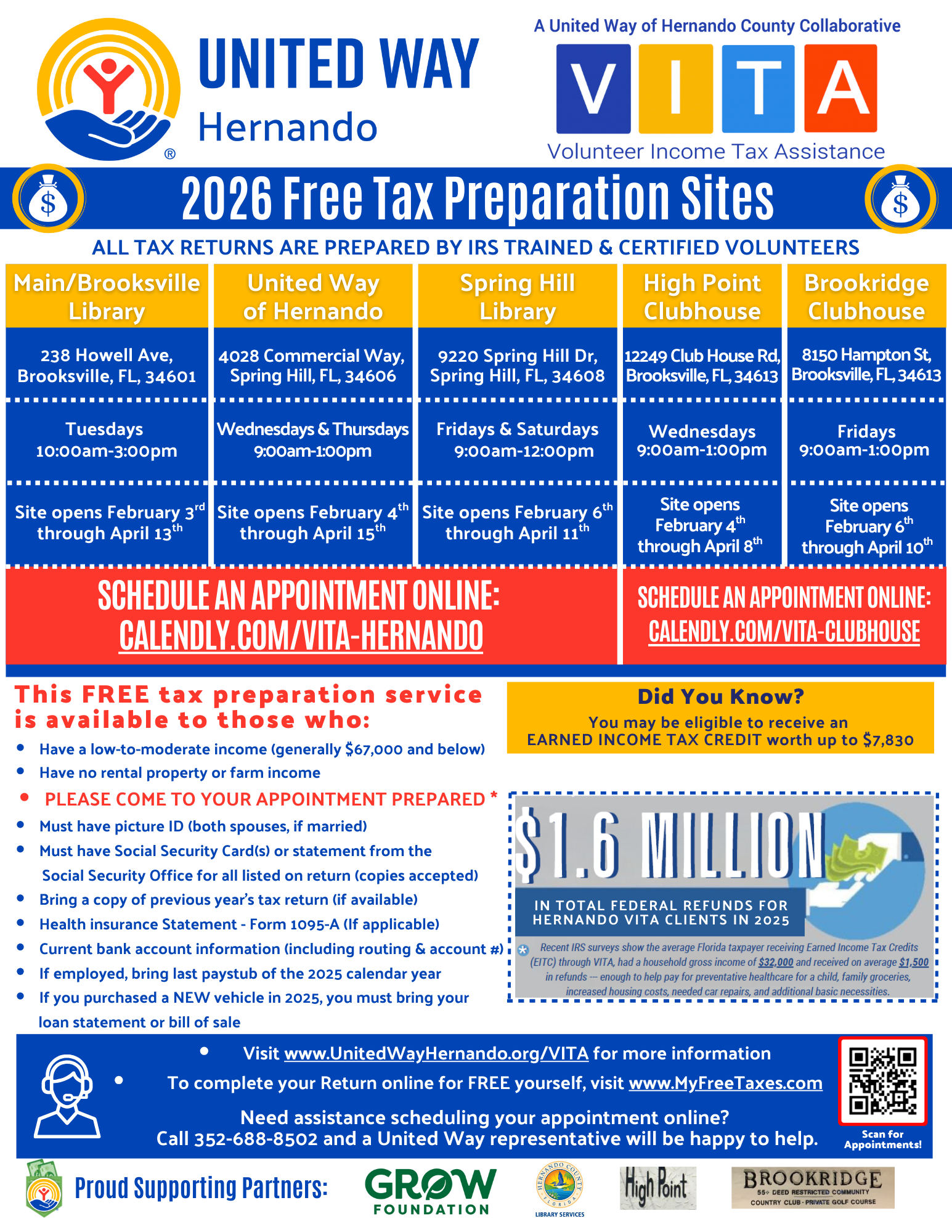

VITA is an annual program where I.R.S certified United Way volunteers provide FREE tax preparation to those who have low to moderate income, no rental property, and no farm income. This program assists taxpayers who are struggling to make ends meet by saving them the cost of tax preparation and helping them claim all tax credits for which they are eligible.

VITA is central to saving families money in hopes of increasing their ability to become or remain financially stable. VITA initiates a positive effect on the economy across the U.S., as families that save costs by having their returns completed for free and receive their return typically spend it on basic living necessities such as rent, bills, food, and car repairs needed.

This free tax preparation is available to those who:

- have a low-to-moderate income (generally, $67,000 and below)

- have no rental property or farm income

- may have a small Schedule C-EZ (expenses $35,000 or less and no net loss)

- must have picture ID

- Social Security Card(s) or statement from Social Security Office for all listed on return (copies accepted)

- If applicable: Form 1095-A (Health Insurance Statement)

- If available, bring a copy of previous year's tax return

-Residents may be eligible to receive the EARNED INCOME TAX CREDIT WORTH up to $7,830

Appointments

Appointments are necessary for all locations. Look above for scheduling options for select locations and visit www.Calendly.com/VITA-Hernando to easily book online. Appointments for both High Point and Brookridge can only be made by visiting www.Calendly.com/VITA-Clubhouse. Need assistance scheduling your appointment online? Call 352-688-8502 and a United Way representative will be happy to help you navigate.

In preparation for your appointment, please familiarize yourself with the most current "Intake/Interview and Quality Review Sheet" you will be required to fill out upon arrival. Please feel free to print and fill out in advance, if you wish. The form may be found on the IRS website HERE.

-Residents can also file their tax return online themselves by utilizing MyFreeTaxes.com

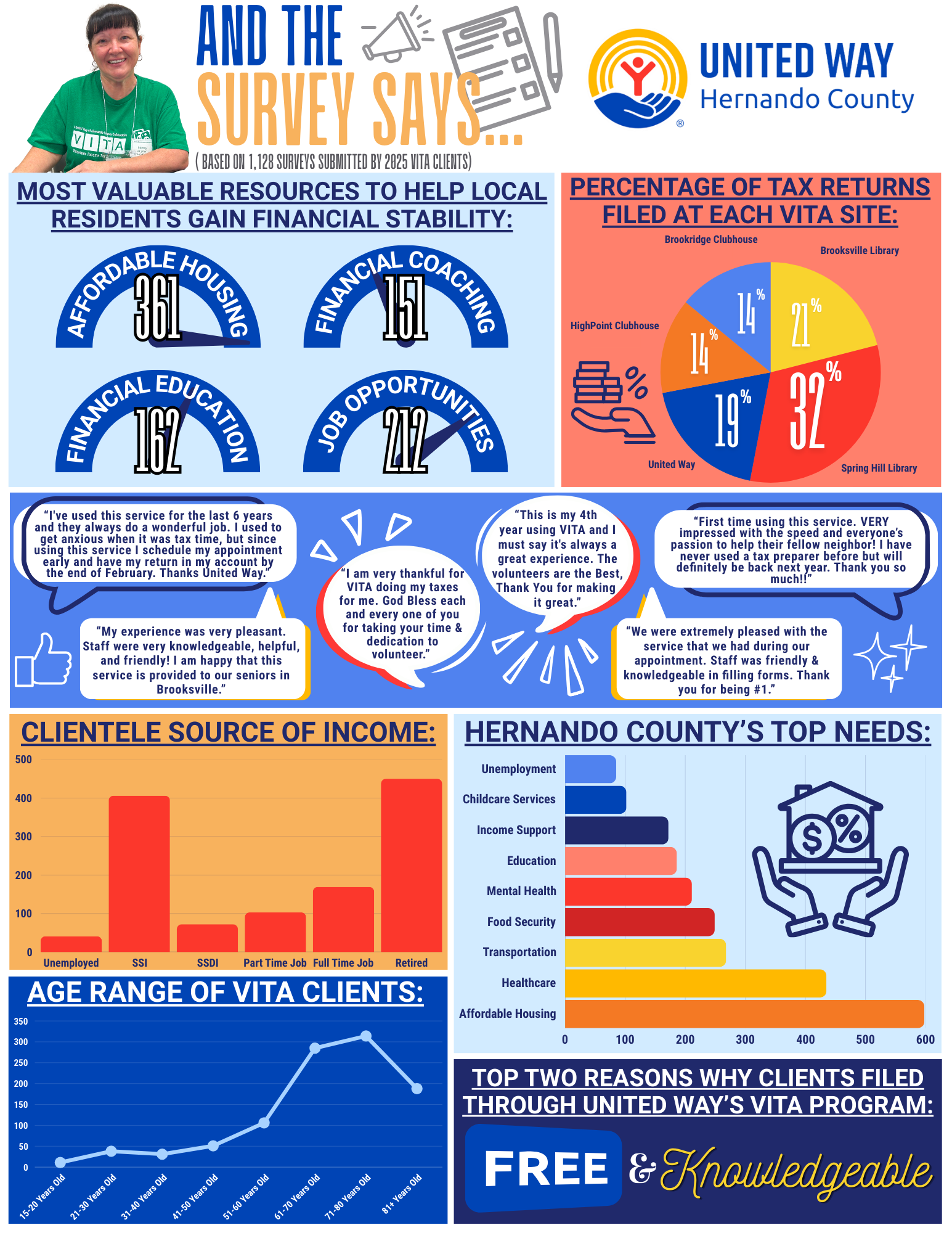

2025 VITA TAX PREPARATION IMPACT

How You Can Help:

Become Trained & Certified

Interested in helping your community? Volunteer to help local residents by preparing their tax returns free of charge through United Way's Volunteer Income Tax Assistance (VITA) program.

Attend a VITA training to become IRS certified for tax season! All volunteers receive free training conducted by the IRS.

Fill out a Lend a Hand Hernando Volunteer Application today! You will be contacted by a representative with more information.

Reasons why you should become a VITA Volunteer:

- The IRS provides free tax law training and materials

- The volunteer hours are flexible

- Hernando VITA sites are located in your community

- Tax Professionals can earn Continuing Education Credits

- Online Training is available

- No prior experience necessary

- It’s people helping people save. It's that simple!

Click here for more information on this initiative from the IRS